Author: Bill Powers, Analytics and Prospect Research Manager

October 10th this year has been set aside to recognize an important, growing, but often overlooked area of philanthropy – Donor Advised Funds (DAFs). This inaugural DAF Day aims to call attention to these funds, and we at The Munshine Group are doing the same.

The rise of donor advised funds in the philanthropic sector has been noted by many leading authorities including the National Philanthropic Trust (NPT), the largest independent charity managing donor advised funds, which granted over $5.49 billion to charities last year. That represents an impressive 18% increase over the previous year. NPT reports that there are some two million donor advised funds in the US, and they averaged more than $117,000 in 2022.

The DAF Day creators say, “Giving with a DAF is proven to nearly double someone’s annual support of the causes they care about (+96%).”

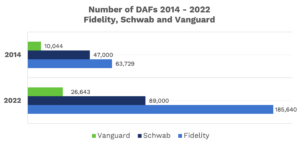

Leading financial institutions know the importance of DAFs to their investors and the charities they support. Fidelity Charitable had nearly 200,000 DAFs last year, nearly tripling the number in less than ten years. Schwab Charitable and Vanguard Charitable, two other leading DAF providers, have seen similar increases, with Vanguard confirming DAFs spur greater total giving overall. Together, DAFs at these big three firms distributed a total of $21 billion last year.

In general, DAFs involve establishing an account with an initial investment. Donors receive an immediate tax benefit once they have established an account (this is considered a charitable gift by the IRS). The donor generally maintains advisory rights on where the funds are distributed, and once invested in a DAF assets generally cannot be refunded.

For fundraising professionals, particularly those involved with database management and prospect research, DAFs have raised a significant challenge to discovering capacity and inclination to give among prospects. At the individual wealth analysis level, it is often not easy for prospect development professionals to uncover total assets or giving information for a particular individual’s DAF. But there are tools and techniques to aid professionals in the process.

As a fundraiser, the most important tool is one you already have at your disposal – your organization’s donor database, which can answer many crucial questions. For example, do you have a way of tracking which of your donors is giving through a donor advised fund? Do you have an attribute for that? How about tagging a donor record simply as DAF if you know that applies? You can also ask your donors how they prefer to give, either using a formal survey or by posing the question during the course of your normal communications. This allows you to target and segment your donors in a more strategic way.

By understanding which of your donors are giving through a DAF, you can gain insights into their philanthropy.

Whatever their reason for establishing a DAF, you can infer that they are motivated to find effective ways to give. Donor advised funds are increasingly among the most creative, flexible and impactful of those methods. We look forward to marking DAF Day, tracking these funds and seeing the donor generosity in action in the years ahead.